- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 05:17 06:33 12:07 15:10 17:34 18:51

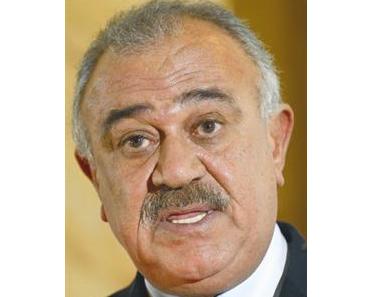

'Inflation levels in the GCC are not worrying,' said Al Shamali (FILE)

The drop in the value of the US dollar is unlikely to lead Gulf Co-Operation Council (GCC) countries to rethink their peg to the currency, the GCC secretary general said on Sunday.

The dollar's slide has caused concern among oil producers as it pushes down the value of their dollar-denominated oil revenues while the price of their commodity imports, such as grains, have been increasing.

When asked whether the drop in the US dollar was pressuring Gulf Arab states to consider other solutions for their currencies, such as depegging, Abdulrahman Al Attiyah told reporters on the sidelines of a conference he did not expect such a move.

"In reality we do not think so... I do not think matters will reach this stage of thinking," he said.

He also said he was happy with the progress of a plan for a monetary union for the region, adding he hoped the UAE would re-join the project.

The UAE abandoned the plan in May 2009 withdrawing in protest against placing the forerunner of the future joint central bank in Riyadh.

"The Emirates is very important. I consider the Emirates a cornerstone of the Gulf monetary union as the second largest economy in the Gulf," said Attiyah, adding he was happy with the progress of the plan.

"We hope that one day Emirates will be part of it," he said.

Earlier, Kuwait Finance Minister Mustapha Al-Shamali said the weak US dollar is not a concern for Gulf economies and Kuwait is likely to increase spending in its budget for the next 2011/12 fiscal year.

The dollar's slide has caused concern among oil producers as it pushes down the value of their dollar-denominated oil revenues while the price of their commodity imports, such as grains, have been increasing.

However, when asked whether there was any concern about the impact of the weak dollar on Gulf Arab economies, Kuwait Finance Minister said: "No".

"Inflation levels in the GCC are not worrying," Shamali was quoted as saying by KUNA, Kuwait's official news agency.

The dollar hit an 11-month low against a basket of currencies earlier this week.

Kuwait, unlike its fellow Gulf oil producers, abandoned its currency peg to the dollar in 2007 in favour of a currency basket to rein in then soaring inflation, which is on the rise again.

A weak dollar also tends to lift oil prices as money shifts from the currency market to commodities in search of better returns.

John Sfakianakis, chief economist at Banque Saudi Fransik, said a weak dollar would have some impact on inflation across the Gulf region but did not see any change in Gulf countries' currency regimes.

"There is plenty of evidence today that the Gulf economies as a whole will neither consider de-valuing or depegging from the dollar as it is neither prudent nor serves an economic purpose," Sfakianakis said.

"However a further weakening of the dollar will have some inflationary pass-through impact," he added.

Price pressures are highest in Saudi Arabia and Kuwait with inflation above 5 percent, whereas in the rest of the Gulf Arab region inflation is more benign.

Shamali also told reporters on the sidelines of a meeting of Gulf finance ministers and central bank governors in Kuwait that the Kuwait government's expenditure would rise in the next fiscal year's budget.

"There is some increase in the budget but we are discussing it," he said.

The world's fourth-largest oil exporter ramped up spending by more than 34 per cent in its current budget for 2010/11, which began in April, partly to diversify its oil-reliant economy and increase the role of the private sector.

The Opec member's 2010/11 budget forecasts a deficit of 6.58 billion dinars or nearly 21 per cent of gross domestic product, assuming oil, the key revenue earner, would fetch $43 a barrel.

Analysts say Kuwait is set to post the biggest surplus in the Gulf of 18.9 per cent of GDP in 2010/11 because its oil price estimate is well below market prices.

Kuwait's budget surplus rose to 5.43 billion dinars in the first six months of the fiscal year ending next March.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.