- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 05:16 06:32 12:06 15:10 17:34 18:51

Photo: WAM

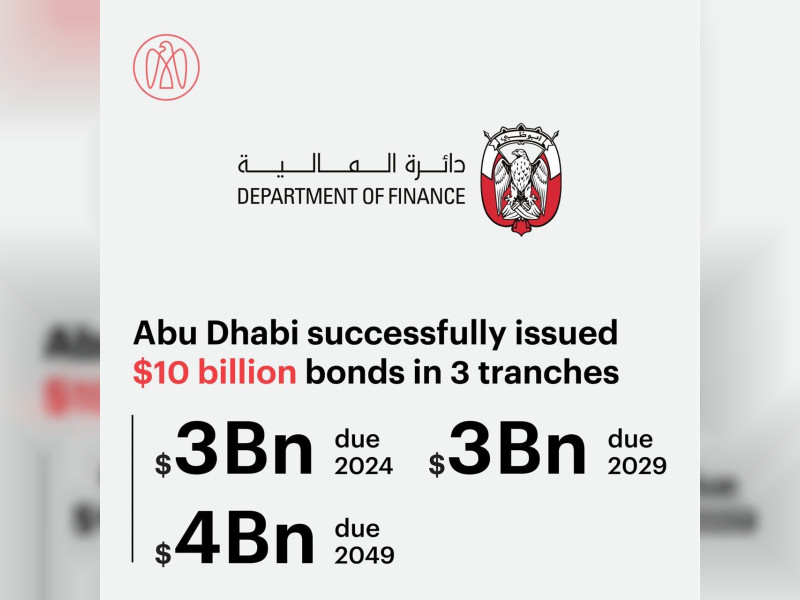

Demonstrating strong investor confidence in its solid credit fundamentals, the Emirate of Abu Dhabi on 23rd September 2019 successfully priced a US$10.0 billion multi-tranche international bond offering. The transaction comprised three tranches: (i) US$3.0 billion, 2.125 percent, due in 2024, which priced at 65 bps over US Treasuries; (ii) US$3.0 billion, 2.500 percent, due in 2029, which priced at 85 bps over US Treasuries; and (iii) US$4.0 billion, 3.125 percent, due in 2049, which priced at 110 bps over US Treasuries.

The bonds were well received in the international debt capital markets, with the order book peaking at over US$25 billion with orders coming from over 650 unique accounts.

Commenting on the offering, Jassem Mohamed Bu Ataba AlZaabi the Chairman of the Department of Finance Abu Dhabi said: "The success of the issuance is a testament of investor confidence in the Government of Emirate of Abu Dhabi’s economic and political stability and the strong credit story. We are pleased to witness the achievement of the lowest ever coupons by the Government of Emirate of Abu Dhabi since the debut issuance in 2007. The Government of Emirate of Abu Dhabi has managed to achieve the tightest 5-, 10-, and 30-year coupon for a GCC conventional bond. This reflects on the investors’ high confidence in the Emirate’s wise leadership, continuous focused growth strategy as well as its high buffers."

Investor confidence in the Government of Emirate of Abu Dhabi’s credit story was reflected in the aggregate orderbook, which reached in excess of US$25 billion from over 650 unique accounts. The transaction marks the largest 30-year tranche by the Government of Emirate of Abu Dhabi and achieved the tightest ever spreads by a MENA sovereign across the tenors and lowest coupon on 10 and 30-years Eurobond achieved by a MENA Issuer since the Government of Emirate of Abu Dhabi’s first ever issuance in 2007.

The Government of Emirate of Abu Dhabi remains the tightest priced sovereign from the MENA region, underpinned by this highly successful transaction, which demonstrates the Government of Emirate of Abu Dhabi’s robust credit fundamentals and strong investor confidence.

The final geographical allocation for the bonds stood at 78% from international investors, and 22% from Middle East investors.

The final geographic allocation for the 5-year Bonds was 75% international investors (9% to Asian investors, 30% to European and UK investors, 36% to US investors) and 25% to investors from the MENA.

The allocation for the 10-year Bonds was 68% international investors (9% to Asian investors, 36% to European and UK investors, 23% to US investors) and 32% to investors from the MENA.

The allocation for the 30-year Bonds was 91% international investors (15% to Asian investors, 31% European and UK investors, 45% to US investors) and 9% to investors from the MENA.

The final investor types allocation for the 5-year Bonds was 56% to fund managers, 36% to banks and corps, 1% to Insurance & Pension Funds, 7% to others.

The final investor types allocation for the 10-year Bonds was 50% to fund managers, 42% to banks and corps, 5% to others, 3% to insurance & Pension Funds. The final investor types allocation for the 30-year Bonds was 71% to Fund managers, 13% to Insurance & Pension Funds, 12% to banks & corporates, 4% to others.

BNP Paribas, Citigroup, First Abu Dhabi Bank, HSBC, J.P. Morgan and MUFG were Joint Lead Managers and Joint Bookrunners, and Abu Dhabi Commercial Bank P.J.S.C. and SMBC Nikko were co-lead managers for the offering.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.