- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 05:43 06:59 12:35 15:40 18:05 19:21

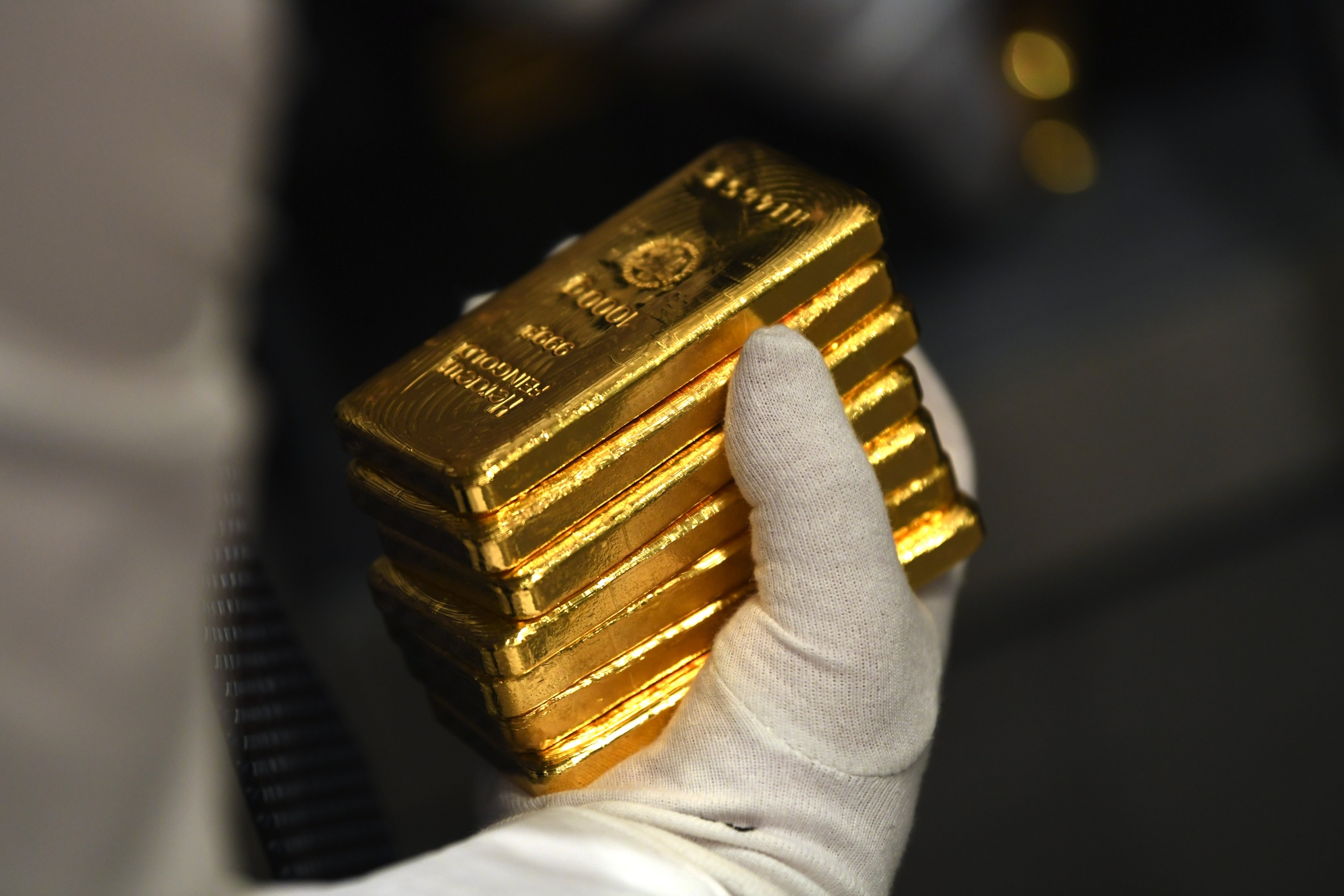

Gold held steady on Tuesday as investors focused on the U.S. Federal Reserve's policy meeting to see if President Donald Trump's policies have an impact on the central bank's views.

Spot gold was nearly steady at $2,738.90 per ounce, as of 0230 GMT. Bullion prices fell more than 1% on Monday as a low-cost Chinese artificial intelligence model triggered a sell-off in the broader market.

U.S. gold futures rose 0.2% to $2,743.10.

Fed policymakers are expected to leave interest rates unchanged on Wednesday, but Trump may complicate the job, after he said last week he wants the central bank to lower borrowing costs.

If the Fed keeps rates unchanged, this would be the first pause in the rate-cutting cycle that began last September.

"If (Fed Chair) Jerome Powell leaves the door slightly more ajar to a potential rate cut in coming months, this may pressure treasury yields and provide an assist to gold," said Tim Waterer, chief market analyst at KCM Trade.

He said the $2,800 level shapes as being a viable near-term target for gold.

Zero-yield bullion tends to be a preferred investment in a low interest rate environment.

Elsewhere, China's net gold imports via Hong Kong fell 84% in December from the previous month, dropping to their lowest since April 2022, data showed on Monday.

Spot silver was down 0.4% at $30.07 per ounce, palladium dropped 0.4% to $957 and platinum fell 0.4% to 943.35.

Analysts have downgraded their price forecasts for platinum and palladium in 2025 as demand prospects struggle to improve significantly, though average prices for both metals are expected to edge higher in 2026, a Reuters poll showed.

Meanwhile, Russia's Nornickel, the world's major producer of palladium, said it produced 2.762 million ounces of palladium in 2024, a 3% increase year-on-year.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.