- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 05:18 06:35 12:07 15:10 17:33 18:50

UAE firms will be the biggest beneficiaries within the Mena region as a result of the opening up of the Iranian economy after the nuclear deal with world powers.

Analysts believe that UAE companies with interests in property, transport, banking and finance sectors will have better prospects to make the most from the upcoming opportunities arising from the removal of sanctions on Iran.

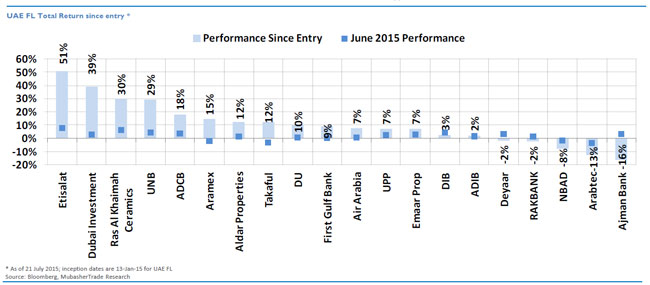

“The UAE is a major winner in terms of trade and inflows. In the UAE, we believe banks and marine terminal and logistics operators should benefit the most. Nine of our 20-constituent UAE Favourite List are financials stocks,” said Mubasher Trade analysts in their note on Mena Strategy equities.

“We believe the most beneficiary markets from the Iran deal with the six global powers will be the UAE and Turkey as investors may choose them to seize Tehran Stock Exchange’s (TSE) recovery when it comes back to the global system. Nine out of our 20-constituent UAE Favourite List are financials stocks.

“We believe UAE banks which have a wide network in terms of branches will play a major role for Iran imports and exports despite the previous three years of sanctions. We see Abu Dhabi Commercial Bank, Dubai Islamic Bank and Abu Dhabi Islamic Bank as the most benefiting stocks once the Iranian trade is revived in addition to any marine terminal and logistics operators, specifically DP World,” said Mubasher Trade Economist Mariam Kamel and Strategist Ahmed Abd Elnaby.

The UAE’s total exports to Iran amounted to $11.5 billion, 95 per cent of which was re-exports last year while imports from Iran amounted to $1.2 billion.

“The figures indicate that the UAE is the largest non-oil trading partner [of] Iran. Consequently, we believe freeing Iran’s economy should immediately spur further export growth from the UAE, which is only hindered by Iran’s current global sanctions and its GDP growth in turn. However, this can be partially offset by the shift of trade to come directly from Europe at the expense of the UAE’s re-exports,” noted Mubasher analysts.

They also see Iranian investments help the Dubai property market.

“Dubai is a favourable destination for Iranians investors, in both mortgage and foreign direct investments given its geographical proximity to Dubai with its high-status as an international trade and business hub.

“We believe lifting sanctions against Iran will provide an even more promising opportunity for the emirate’s growing real estate market,” the analyst said in the note.

A research note released by Bank of American-Merrill Lynch revealed that removal of sanctions could help Iran’s domestic demand rebound rapidly, especially if oil exports normalise to pre-2012 level.

“Our analysis suggests that the Iranian economy would have matched the size of Saudi Arabia were it not for sanctions. We think the deal is likely to bring macro benefits to Iran in three stages – cash, trade and investment,” the US bank said.

Among the UAE industries that will benefit most based by BofA-ML analysis are Dubai real estate, banks and UAE transport sectors. Dubai-based companies Emaar Properties and global ports operator DP World will be the biggest beneficiary from the removal of the sanctions on Iran.

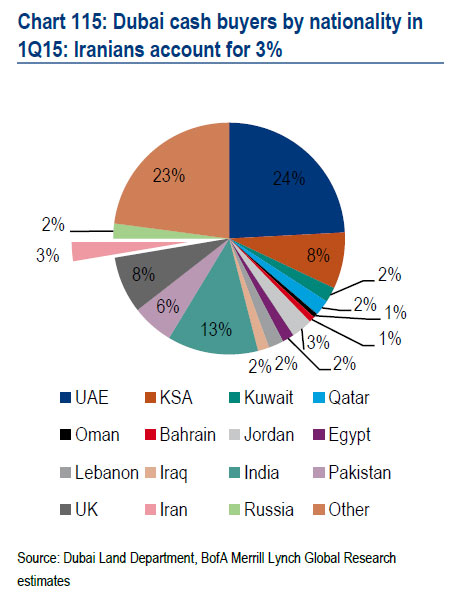

Iranian investors were among the top cash buyers of Dubai property in 2010, accounting for 12 per cent of total Dubai cash transactions. They were fourth biggest group of property purchasers after Indians, Britons and Pakistanis. But after the sanctions, Iranian investments in the emirate’s property market plunged, reaching its trough to-date. Iranian cash buyers represented just three per cent of the total Dubai cash transactions in the first quarter of 2015.

The US bank estimates that the Iranian investments in the emirate’s property market could go back to the peak level of 12 per cent, amounting to total incremental capital inflow of $2.4 billion annually by the removal of sanctions on Iran. Similarly, guest arrivals to Dubai are also expected to surge.

BofA-ML predicted that the removal of sanctions could imply $200 billion in annual import demand by 2020, from $80 billion now.

“We believe UAE and Turkey are best positioned to enjoy potential upside in Iranian trade volumes. The deal should also support South Caucasus via freer trade, but could have some negative spill-over effects on Russia via lower oil prices or eventual competition to supply gas to Europe. Still, sustaining any boost in activity would require Iranian macro reforms, we think,” the US bank analysts noted.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.