- City Fajr Shuruq Duhr Asr Magrib Isha

- Dubai 05:43 07:01 12:27 15:25 17:47 19:05

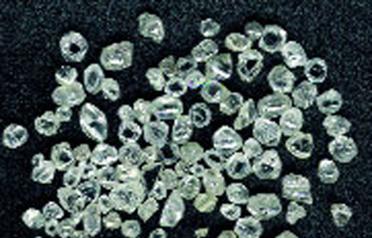

Dubai recorded 44% rise in rough diamond exports in the first half of 2008 to $1.88bn. (FILE)

During the first six months of 2008, rough diamond imports to the emirate grew by 23 per cent to reach $1.15bn from $937 million, during the same period in 2007. This was mainly driven by high volumes imported from Angola (75 per cent), and a 138 per cent rise in imports from China.

Exports in the first half of 2008 rose by 44 per cent to reach a total of $1.88bn from $1.3bn, during the same period in 2007. Over 87 per cent of Dubai’s rough diamond exports were to the countries of the European Commission (EC) and India, while Dubai’s exports to China increased by 950 per cent.

Angola, India, Europe and China were the top diamond trade partners for Dubai, and jointly accounted for around 85 per cent of total trade volumes.

Ahmed Bin Sulayem, Executive Chairman, DMCC, and Deputy Chairman of DDE, said: “The continued surge in diamond trade is testament to Dubai’s success in attracting traders from around the world. We have witnessed healthy growth in bilateral trade with various countries, reflecting the growing confidence in the trading infrastructure and opportunities offered by Dubai.”

Sulayem highlighted that earlier this year, DMCC signed significant MoUs with People's Government of Panyu District, China, and Gems & Jewellery Trade Association of China (GAC), for promotion of jewellery trade between both countries, with a special focus on diamonds and coloured stones.

In addition, DMCC assisted HSBC establish a diamond banking unit to enable access to finance for the local and regional diamond trade.

Youri Steverlynck, Chief Executive Officer, Dubai Diamond Exchange, said: “While exports in terms of carats grew marginally in the first half of 2008, the price of diamond rose by 10 per cent and helped push the overall trade to high levels. We have also been witnessing a sharp increase in rough diamond inventories held in Dubai, which underlines Dubai’s status as a major distribution conduit for leading manufacturing markets. To further such initiatives, DDE plans to hold rough diamond sales weeks every month, starting from August 24, 2008. Diamonds traded via the DDE during the proposed sales weeks will include production from various mines across the world.”

The DDE remains the only exchange in the region to service the diamond trade from mining to retail. The DDE is also one of the few diamond bourses worldwide to conduct B2B diamond tenders, enabling sellers to reach a wider market. The UAE is a member of the Kimberly Process Certification Scheme, which ensures that the rough diamonds imported to and exported from the UAE have been mined in a legitimate manner.

DDE is one of the members of the World Federation of Diamond Bourses enabling its members access to international member exchanges.

DDE, a unit of Dubai Multi & Commodities Centre and Dubai government initiative, rated ‘A’ by Standard & Poor’s, promotes and strictly adheres to the Kimberley Process Certification Scheme.

Its members represent global players from New York, Antwerp, South Africa, Mumbai, the UAE and other international centres.

![]() Follow Emirates 24|7 on Google News.

Follow Emirates 24|7 on Google News.